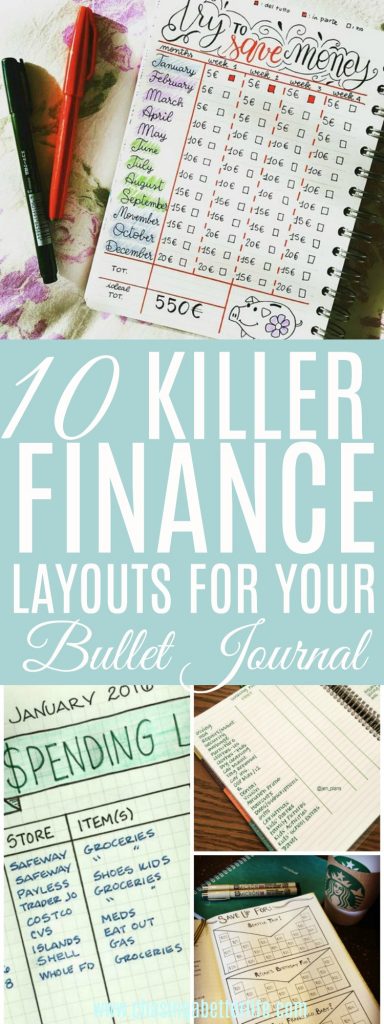

10 Ways a Bullet Journal Finance Tracker Can Help You Take Control of Your Money Now!

Looking for an effective way to track your health and fitness goals? A bullet journal habit tracker might be the answer. Customizable and flexible, a bullet journal habit tracker can help you stay organized and motivated as you work towards your goals. Give it a try and see the positive impact on your own health and wellness journey.

The Bullet Journal is a popular organizational system that combines the flexibility of a notebook with the structure of a planner. Using a Bullet Journal can help you increase your productivity and stay on top of tasks and goals.

One specific application of a Bullet Journal is budgeting and managing your finances. By setting up a budget spread and tracking your income, expenses, and savings, you can gain a better understanding of your financial situation and make more informed decisions about how to manage your money.

In this article, we will explore how to use a Bullet Journal for budgeting and managing your finances, including techniques for tracking and analyzing your spending and setting and achieving financial goals. Whether you are trying to pay off debt, save for a big purchase, or simply want to get a better handle on your finances, a Bullet Journal can be a valuable tool.

What is a Bullet Journal and What are its Benefits for Organization and Productivity?

A Bullet Journal is a customizable and adaptable organization system created by Ryder Carroll, a digital product designer. It is designed to help you track and manage your tasks, events, and notes in a simple and efficient way. The Bullet Journal uses a modular structure and a set of symbols (or "bullets") to help you prioritize and categorize your tasks and notes.

The main benefit of using a Bullet Journal is that it can help you increase your productivity and stay on top of tasks and goals. By keeping all of your tasks and notes in one place, you can avoid the need to switch between multiple apps or notebooks, which can save you time and reduce stress. The Bullet Journal's flexible structure allows you to adapt it to your specific needs and workflow, so you can customize it to fit your style and preferences.

In addition to its practical benefits, many people find that using a Bullet Journal can be a creative and therapeutic outlet. The act of writing and drawing in a physical journal can be a calming and mindful activity, and the process of setting and achieving goals can be rewarding and fulfilling.

Overall, the Bullet Journal is a powerful tool for organization and productivity that can help you stay on top of tasks, events, and notes, and achieve your goals in a way that is tailored to your needs and preferences.

What you need to start with these bullet journal ideas:

Before you move into the lovely bullet journal ideas I have to show you, I want to recommend some of the products I use for my own bullet journaling.

- This is the exact Bullet Journal I use.

- These are the markers I personally use. You can go with fancy Tombows but I like these.

- These are the stencils I use. They are metal with their own case.

- This is the washi tape I use. I like skinny tape.

27 Bedroom Organization Tips for a Clutter-Free Space

Here is a step-by-step guide on how to create a budget spread in your Bullet Journal:

- Choose a layout for your budget spread. You can create a simple table with columns for different categories of expenses, or you can use a more visual layout, such as a pie chart or bar graph.

- Identify your income sources. Write down all the sources of income you have, such as your salary, any side hustles or freelance work, and any other sources of income.

- Create a list of your regular expenses. These might include things like rent or mortgage payments, utilities, groceries, car payments, and other recurring bills.

- Track your spending. Each time you make a purchase, record it in your budget spread. Be sure to categorize your expenses so you can see where your money is going.

- Review your budget regularly. Set aside time each week or month to review your budget and see how you are doing. Are you on track to meet your financial goals? Are there any areas where you can cut back on expenses or save more money?

- Make adjustments as needed. If you find that you are overspending in a certain category, try to find ways to reduce your expenses. If you have extra money left over, consider putting it towards a financial goal, such as paying off debt or saving for the future.

By following these steps and regularly reviewing and adjusting your budget, you can use your Bullet Journal to effectively track and manage your finances.

Tips on How to Track Income, Expenses, and Savings on a Bullet Journal Finance Tracker

Here are some tips on how to track income, expenses, and savings in your Bullet Journal Finance Tracker:

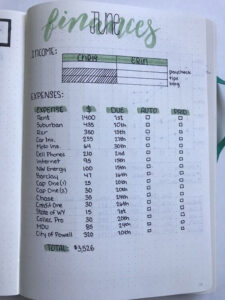

- Track income: Make a list of all your income sources and the amount of money you receive from each one. You can create a separate page for this or include it as part of your budget spread. Be sure to include any irregular or infrequent income, such as gifts or bonuses.

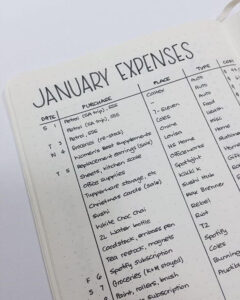

- Track expenses: Create a list of categories for your expenses and record each purchase you make in the appropriate category. You can use a simple table with columns for different categories, or you can use a visual layout such as a pie chart or bar graph. Be sure to include all of your expenses, including fixed costs like rent and bills, as well as variable costs like groceries and entertainment.

- Track savings: Record any money you save or put towards a financial goal, such as paying off debt or building an emergency fund. You can create a separate category for savings or include it as part of your budget spread.

- Use symbols or colors to prioritize and categorize tasks: You can use symbols or colors to indicate the priority or status of tasks or expenses. For example, you could use a red dot to indicate a high-priority task or expense, or a green dot to indicate a completed task.

By following these tips and regularly reviewing and adjusting your budget, you can effectively track your income, expenses, and savings and make informed decisions about how to manage your money.

Ideas for using habit/task trackers to stay on top of financial goals

Here are some ideas for using habit/task trackers in your Bullet Journal to stay on top of financial goals:

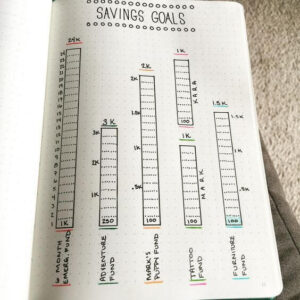

- Create a financial goal tracker: Make a list of your financial goals and use a habit tracker to track your progress towards each one. You could track things like paying off debt, saving a certain amount of money, or reducing expenses in a specific category.

- Use a monthly budget tracker: Create a monthly budget tracker to record your income and expenses for each month. This can help you see how much money you have available to put towards your financial goals and identify areas where you can cut back on expenses.

- Set up a daily or weekly budget check-in: Use a daily or weekly task tracker to set aside time to review your budget and see how you are doing. You can use this time to make any necessary adjustments to your budget or to check in on your progress towards your financial goals.

- Use a habit tracker to track financial habits: You can use a habit tracker to track financial habits such as creating a budget, tracking your expenses, or saving a certain amount of money each month. This can help you build good financial habits and stay on track towards your financial goals.

By using habit/task trackers in your Bullet Journal, you can stay organized and focused on your financial goals and make progress towards achieving them.

Using your Bullet Journal Finance Tracker to track and analyze your spending

Using your Bullet Journal Finance Tracker to track and analyze your spending can be a powerful tool for managing your finances and identifying areas where you can cut back on expenses and save more money. Here are some tips on how to use your Bullet Journal to track and analyze your spending:

- Record and categorize your purchases: Each time you make a purchase, record it in your budget spread and assign it to a specific category, such as groceries, entertainment, or transportation. This will help you see where your money is going and identify areas where you are spending the most.

- Use visual representations of your spending: Consider creating visual representations of your spending, such as pie charts or bar graphs, to help you see where your money is going at a glance. This can make it easier to identify patterns and trends in your spending.

- Identify areas where you can cut back: Once you have a good understanding of your spending habits, look for areas where you can cut back on expenses. For example, if you notice that you are spending a lot of money on dining out, you might try cooking more meals at home or packing your lunch to save money.

- Set and track financial goals: Use your Bullet Journal to set and track financial goals, such as paying off debt or saving for a down payment. This can help you stay motivated and focused on achieving your financial goals.

By using your Bullet Journal to track and analyze your spending, you can gain a better understanding of your financial situation and make informed decisions about how to manage your money.

Techniques for recording and categorizing purchases in your Bullet Journal Finance Tracker

There are several techniques you can use to record and categorize purchases in your Bullet Journal Finance Tracker:

- Create a simple table with columns for different categories: You can create a simple table in your Bullet Journal with columns for different categories of expenses, such as groceries, transportation, entertainment, and so on. Each time you make a purchase, record it in the appropriate category.

- Use a visual layout, such as a pie chart or bar graph: A visual layout can make it easier to see where your money is going at a glance. You can create a pie chart or bar graph in your Bullet Journal to show the proportion of your budget that is being spent in each category.

- Use symbols or colors to indicate the type of purchase: You can use symbols or colors to indicate the type of purchase you are making. For example, you might use a green dot to indicate a purchase in the "groceries" category, or a red dot to indicate a purchase in the "entertainment" category.

- Group similar expenses together: If you have a lot of small expenses in a particular category, you might find it helpful to group them together. For example, instead of recording each individual coffee purchase, you could create a category called "coffee and snacks" and record the total amount you spend in that category each month.

By recording and categorizing your purchases in your Bullet Journal, you can gain a better understanding of your spending habits and identify areas where you can cut back on expenses and save more money.

Ideas for creating visual representations of your spending (e.g. pie charts, bar graphs) in your Bullet Journal Finance Tracker

21 DIY Jewelry Organizers: A Practical and Stylish Way to Store Your Collection

Creating visual representations of your spending, such as pie charts or bar graphs, can be a useful way to see where your money is going at a glance and identify patterns and trends in your spending. Here are some ideas for using visual representations of your spending in your Bullet Journal:

- Use a pie chart: A pie chart can show the proportion of your budget that is being spent in each category. To create a pie chart in your Bullet Journal, divide a circle into wedges that represent the different categories of expenses. The size of each wedge should be proportional to the amount of money you are spending in that category.

- Use a bar graph: A bar graph can show the amount of money you are spending in each category. To create a bar graph in your Bullet Journal, draw a horizontal axis with tick marks representing the different categories of expenses. Then draw vertical bars that represent the amount of money you are spending in each category.

- Use a combination of pie charts and bar graphs: You can use a combination of pie charts and bar graphs to show both the proportion and the amount of money you are spending in each category.

By creating visual representations of your spending, you can gain a better understanding of your financial situation and identify areas where you can cut back on expenses and save more money.

Tips on how to identify areas where you can cut back on expenses and save more money

Here are some tips on how to identify areas where you can cut back on expenses and save more money:

- Track your spending: The first step in identifying areas where you can cut back on expenses is to track your spending. By recording and categorizing your purchases in your Bullet Journal, you can see where your money is going and identify areas where you might be able to save.

- Look for patterns and trends: As you track your spending, look for patterns and trends in your spending habits. For example, if you notice that you are spending a lot of money on dining out or buying coffee, you might be able to save money by cooking more meals at home or bringing your own coffee to work.

- Set and track financial goals: Use your Bullet Journal to set and track financial goals, such as paying off debt or saving for a big purchase. This can help you stay focused on your financial goals and motivate you to cut back on expenses.

- Review your budget regularly: Set aside time each week or month to review your budget and see how you are doing. Look for areas where you can cut back on expenses and consider ways to save more money, such as reducing your monthly bills or cutting back on non-essential purchases.

By following these tips and regularly reviewing your budget, you can identify areas where you can cut back on expenses and save more money.

Advanced budgeting techniques with your Bullet Journal Finance Tracker

Once you have a handle on the basics of budgeting with your Bullet Journal, you can try out some advanced techniques to take your budgeting to the next level:

- Use your Bullet Journal to plan for irregular or infrequent expenses: Many expenses, such as insurance premiums or property taxes, don't occur on a regular basis. Use your Bullet Journal to track these irregular expenses and plan for them in your budget.

- Create a long-term financial plan: Use your Bullet Journal to create a long-term financial plan that includes both short-term and long-term goals. Consider factors such as your current financial situation, your future income and expenses, and your desired lifestyle.

- Use your Bullet Journal to track your net worth: Your net worth is the total value of your assets (such as savings, investments, and property) minus your liabilities (such as debt). Use your Bullet Journal to track your net worth over time and see how it changes as you make progress towards your financial goals.

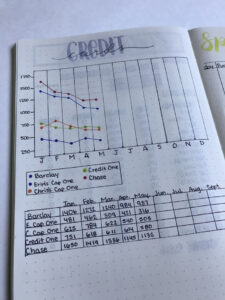

- Use your Bullet Journal to track your credit score: Your credit score is a measure of your creditworthiness and can impact your ability to get loans or credit cards with favorable terms. Use your Bullet Journal to track your credit score and identify ways to improve it, such as paying your bills on time and reducing your debt.

By using these advanced budgeting techniques with your Bullet Journal Finance Tracker, you can take your financial planning to the next level and work towards your long-term financial goals in a more organized and efficient way.

Keto Slow Cooker: 70 Recipes You Need In Your Life

Using your Bullet Journal to set and track financial goals (e.g. paying off debt, saving for a down payment)

Using your Bullet Journal to set and track financial goals can be a powerful way to stay motivated and focused on achieving your financial goals. Here are some tips on how to use your Bullet Journal to set and track financial goals:

- Identify your financial goals: Take some time to think about what your financial goals are. Do you want to pay off debt, save for a down payment, or build an emergency fund? Make a list of your financial goals and prioritize them in order of importance.

- Create a plan to achieve your goals: Once you have identified your financial goals, create a plan to achieve them. This might include setting specific target amounts, creating a budget, or finding ways to increase your income.

- Track your progress: Use your Bullet Journal to track your progress towards your financial goals. You can create a habit tracker to track specific actions you are taking to achieve your goals, or you can create a page to record your progress over time.

- Celebrate your successes: As you make progress towards your financial goals, take the time to celebrate your successes. This can help you stay motivated and keep moving forward.

By using your Bullet Journal to set and track financial goals, you can stay focused and motivated as you work towards achieving your financial goals.

Ideas for using your Bullet Journal to plan for irregular or infrequent expenses (e.g. insurance premiums, property taxes)

Irregular or infrequent expenses, such as insurance premiums or property taxes, can be challenging to plan for because they don't occur on a regular basis. Here are some ideas for using your Bullet Journal to plan for these types of expenses:

- Create a calendar: Use your Bullet Journal to create a calendar that shows when you need to pay each irregular or infrequent expense. You can use different colors or symbols to indicate different types of expenses.

- Record the amount and due date of each expense: Along with the date, record the amount and due date of each irregular or infrequent expense in your Bullet Journal. This will help you keep track of what you need to pay and when.

- Set aside money each month to cover these expenses: One way to plan for irregular or infrequent expenses is to set aside a certain amount of money each month to cover them. For example, if you know you need to pay $1,000 in property taxes each year, you could set aside $83.33 each month to cover that expense.

- Review your budget regularly: Set aside time each month to review your budget and make sure you are on track to cover your irregular or infrequent expenses. This will help you avoid surprises and stay on top of your financial obligations.

By using your Bullet Journal to plan for irregular or infrequent expenses, you can be better prepared to handle these types of expenses and stay on track with your budget.

Tips on how to use your Bullet Journal to create a long-term financial plan

A long-term financial plan is a roadmap that helps you achieve your financial goals over a period of time. Here are some tips on how to use your Bullet Journal to create a long-term financial plan:

- Identify your financial goals: Take some time to think about what your long-term financial goals are. Do you want to pay off debt, save for retirement, or buy a house? Make a list of your financial goals and prioritize them in order of importance.

- Assess your current financial situation: To create a long-term financial plan, you need to have a good understanding of your current financial situation. This might include things like your income, expenses, debts, and assets. Use your Bullet Journal to record this information and get a clear picture of where you are starting from.

- Create a budget: A budget is a key component of a long-term financial plan. Use your Bullet Journal to create a budget that takes into account your income, expenses, and financial goals. Be sure to include both short-term and long-term goals in your budget.

- Set specific target amounts: To help you stay motivated and on track, set specific target amounts for each of your financial goals. For example, if you want to pay off debt, set a target amount for how much you want to pay off each month.

- Review and adjust your plan regularly: As you work towards your financial goals, be sure to review and adjust your plan regularly. Things may change over time, so it's important to stay flexible and make adjustments as needed.

By using your Bullet Journal to create a long-term financial plan, you can stay organized and focused on achieving your financial goals and make progress towards a secure financial future.

15 Fun & Festive Gifts In A Jar

Using a Bullet Journal for budgeting and managing finances can be a powerful tool for staying organized and on track with your financial goals. By tracking your income, expenses, and savings, creating a budget, and setting and tracking financial goals, you can gain a better understanding of your financial situation and make informed decisions about how to manage your money.

In addition to helping you stay organized and on track, using a Bullet Journal for budgeting and managing finances can also be a rewarding and satisfying experience. It can help you feel more in control of your finances and give you a sense of accomplishment as you make progress towards your financial goals.

So why not give it a try? Whether you are just starting out with budgeting or you are looking for new ways to improve your financial situation, using a Bullet Journal can be a helpful and effective tool. Give these techniques a try and see how they can help you take control of your finances and work towards a brighter financial future.

What you need to start with these bullet journal ideas:

Before you move into the lovely bullet journal ideas I have to show you, I want to recommend some of the products I use for my own bullet journaling.

- This is the exact Bullet Journal I use.

- These are the markers I personally use. You can go with fancy Tombows but I like these.

- These are the stencils I use. They are metal with their own case.

- This is the washi tape I use. I like skinny tape.

Now let’s get you looking at these awesome bujo spreads...

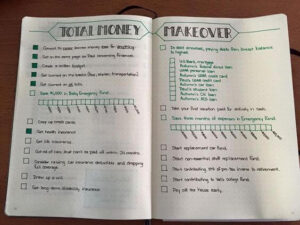

Total Money Makeover

This one is done as a checklist of what they want to accomplish from obtaining health insurance to their debt snowball.

Baby steps

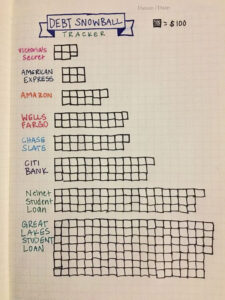

Debt Snowball

Debt Snowball 2

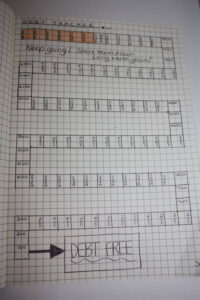

Debt Tracker

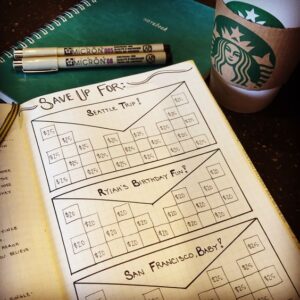

Savings Layout

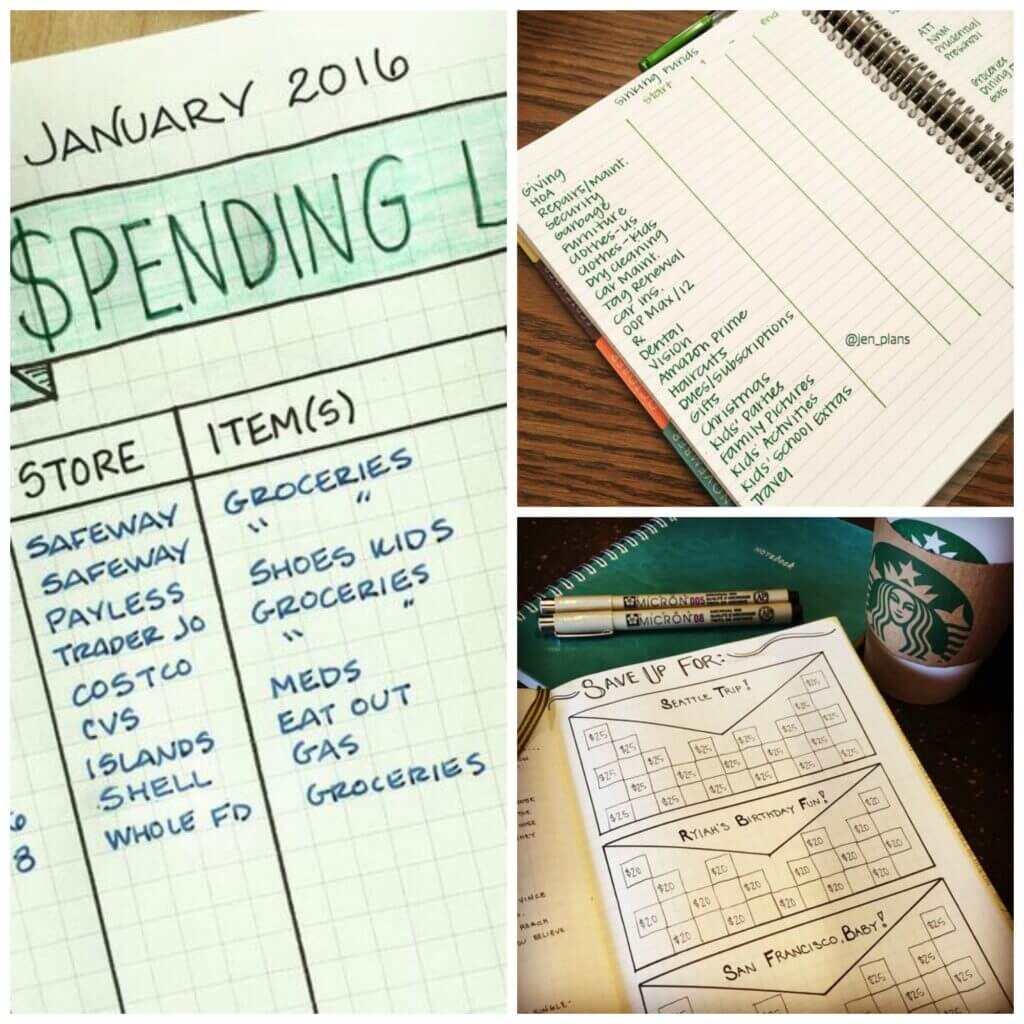

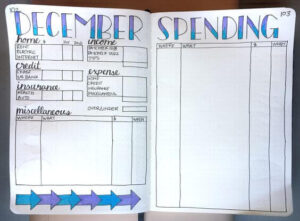

Monthly Spending Layout

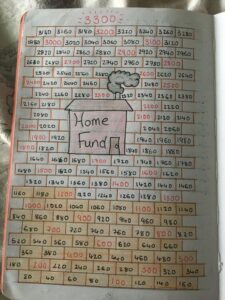

Saving For A Home Layout

Sinking Funds from @jen_plans

Credit Card Tracker

Monthly Bullet Journal Finances Layout

Track Spending

Budget Tracker

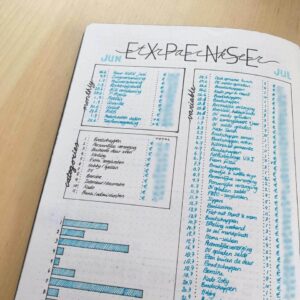

Expense Tracker

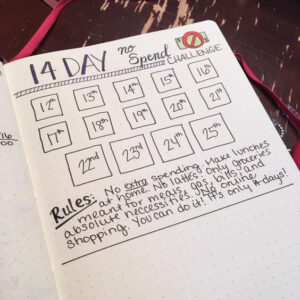

No-Spend Financial Trackers

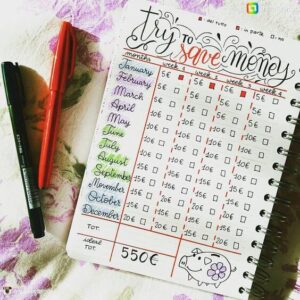

Money-Saving Plan

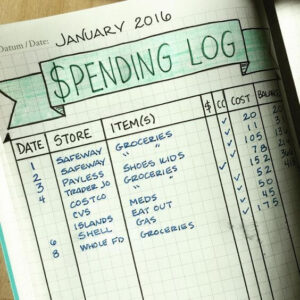

Spending Log

Saving Goals

Tracking Expenses

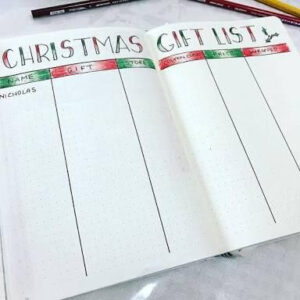

Gift Giving Financial Trackers

4 Comments

Stacy Whitmore

I love that you make it fun, interesting and visual. I am so doing something like this! It gives me great ideas on how to track my debt payoff and on to freedom

Pingback:

Pingback:

Lisa

I copied your layout design for saving up a down payment, but I altered it so that I’m counting down how much I still owe on my mortgage. I can’t wait to color in the bricks every month when I make my mortgage payment! 🙂